Learn How Your Credit Score Affects Your Life In 5 Key Areas

Take This 2-minute Assessment To Find Out

Get started nowUnderstand. Take Action. Reduce Stress.

Your credit determines your financial life... your credit score is used by lenders almost exclusively to determine what you will pay for a loan.

It doesn't matter if you have money in the bank or a well-paying job.

If your credit score isn’t excellent then you will pay a huge penalty on a mortgage, refinance, auto loan, credit cards, or any other type of loan.

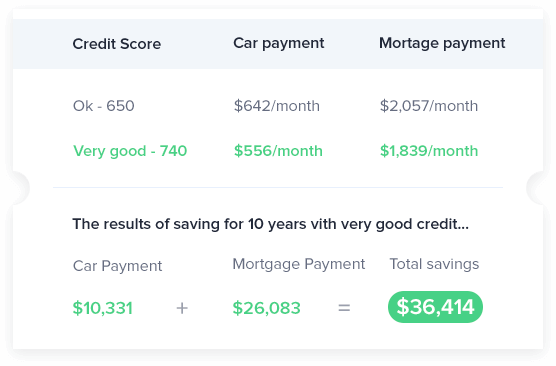

How much more? Take a look below.

Good Credit Can Help You Save Money

Good Credit Can Help You Save Money

Over your lifetime the cost of higher interest rates can really add up.

That’s money paid out to lenders that you could use to live a better life – take more vacations, cover college education costs for your children, live in a bigger house, drive a nicer car, or invest the savings for retirement.

And it’s even worse if you have bad credit, considered by lenders to be anything below 620. It’s extremely difficult to get a mortgage, car loan, or a credit card at all with a credit score below this mark.

Luckily there are steps you can take to improve your credit – and in many cases improvement can be seen relatively quickly3 when you have the right education to guide you.

About The Credit Solution Program

Mike Roberts is the founder of the Credit Solution Program.

Mike Roberts is the founder of the Credit Solution Program. He has seen how important understanding credit has been in improving his own life. And because of this Mike has dedicated himself to teaching others how to improve their lives by raising their credit score and taking control of their personal finances.

The Credit Solution Program is a unique system that aims to educate with engaging videos that are both informative and fun to watch. The content on the site and in CSP products is created by Mike Roberts and a team of subject matter experts.

What Steps Will You Take With The Credit Solution Program?

1. You have to start to understanding where your credit score is?

So, the 1st step is awareness – take stock of your current credit situation, and this means understanding everything that’s on your credit reports today. You may be surprised at what you find. Now, once you know what is on your credit report, the question is… why does it matter? And more importantly, what can be done to have the biggest impact on your score right now?

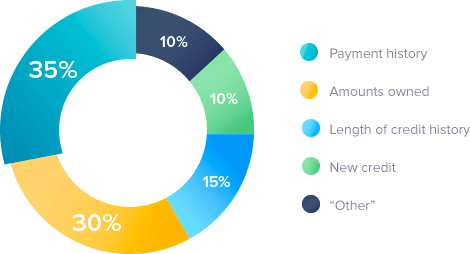

2. You need to know how credit scoring works?

You’ll learn how to interpret the 5 factors that affect your score. To see what’s holding you back from having the highest possible score, you need to know how credit scoring works. Are you doing the right things to improve your score and keep your credit score high in the future?

3. You have to understand how to deal with problems

Finally, you have to understand how to deal with any problems on your credit report. What kind of problems? Negative items like inquires, late payments, collections accounts, judgments, or even bankruptcy.

These may be reported in error. You’ll learn how to approach each negative mark based on your own report.

What Happens When You Follow The Credit Solution Program?

We train you on the importance of credit.

Here we lay the foundation, so that you have the proper mindset to continue. This is not just about money either, employers, landlords, and insurance companies all use your credit score to make decisions that can have a big impact on your life.3, 4, 5,

According to MSN Money personal finance columnist Liz Pulliam Weston in her 2011 National Best Seller “Your Credit Score” – a series of small mistakes with credit can add up to $2M due to high interest rates over a lifetime.

And there is more that happens once you really understand what a great score is worth.

Understand what factors affect your score

Understand what factors affect your score

Do you know all the factors that go into calculating a credit score? When you understand the 5 factors that are used to determine your score, you are able to begin working on each to improve your score.*

Most people with great credit have no idea how it got that way. So even if you have great credit already, this is a lesson you will not want to miss if you plan on keeping your credit high in the future.

Learn to interpret your credit report

Learn to interpret your credit report

You will learn where to get your credit reports and scores online, and how to understand each section of your report.

We will walk you through an exercise to classify any negative items according to the CSP system. This provides the framework from which you will form a personalized action plan.

Many people are confused about how to understand each section of a credit report. It’s no surprise really… did you know that if you have a lengthy credit history, your report can be over 20 pages long?

Understanding how to interpret all of this information about you is the first step toward improving it.

Regain control over your finances

Regain control over your finances

In the past 3 years, we have provided education to over 1.2 million people about credit and financial health topics. Over that time, we have received many tens of thousands of blog comments and support emails from visitors to this site. Because of this, we have an in depth understanding of the variety of problems that you may be facing with your credit.

Find out how to deal with late payments or accounts that have gone to collections. You will learn how to evaluate your options for any debts that you have outstanding, and how each choice may affect your credit score. You’ll also learn what actions are the most important if you want to qualify for a loan in the near future.

Shape your actions to keep your score up

Shape your actions to keep your score up

It’s frustrating to most people when they find out that just paying bills on time is not enough to insure that you will have an excellent credit rating. The credit scoring model is looking for a responsible use of credit, and while paying bills on time is a big part of that – it’s not enough.

What is the proper way to structure your credit history going forward?

Yes, in order to have the highest possible score, you have to actually plan out a strategy that the credit scoring model views as low risk. This means having the right number of credit cards and mix of credit types. We’ll show you how to use your credit effectively in order to score well.

Three Great Ways to Engage

The Credit Solution Program

Newsletter

Get credit, debt help and personal finanse updates that 1.2 Million subscribers trust!

- Exclusive subscriber only training content

- Get notified of all our best content

- Save with subscriber only product offers

Instant access , no credit card required Yours at no cost upon email registration Easy 1-click unsubscribe at any time

Home Study

Credit Solution Program

If you want to study our full program any time than the Credit Solution Program is your best choice.

- Learn about credit with our self-guided approach

- Personalized Success Journal

- Community of over 20,000 students

Get started fixing your credit today

Interactive + Personalized

Financial Health Assessments

New to the Credit Solution Program and want to learn more with content designed especially for you?

- Complete questionnaire

- Get your personalized assessment

- Enjoy customized content

Instant access , no credit card required Yours at no cost upon email registration Easy 1-click unsubscribe at any time

Here's What Our Students and Subscribers Have to Say...

"It was all about understanding what makes a good credit score."

Went from renting and a poor credit rating, 570-ish, to purchasing a home and 728 current credit score in about 6 months. It was all about understanding what makes a good credit score. Not what I thought it was. Thanks for educating me.*"I recommend this information and credit kit to anyone."

Your information has been very valuable in restoring my credit score, I recommend this information and credit kit to anyone. It has truly been a blessing to my life as it will be for yours.*"We purchased a duplex investment property at a great mortgage rate."

In November of 2013 we sold our 2 bedroom condo for a house, paid off all my student loans, paid our debt down. In Dec of 2014 thanks to your site and applying the tips you suggested, we purchased a duplex investment property at a great mortgage rate. Thank you for all of the helpful tools!*"Wish I had run across much of this years ago!!*"

"The emails are very informative.*"

"All emails are saved and are increasing my financial IQ."

Went through a divorce which financially destroying credit. All emails are saved and are increasing my financial IQ. I am very grateful that you are helping me in regards to financial decisions.*"Because of your program, my credit scores are now 671, 638, 645, and still climbing!"

Thank you so much! I started this program in mid-September. My credit score was 550...because of your program, my credit scores are now 671, 638, 645, and still climbing! I started off by getting a secured credit card, kept the balance at $0 and I now have an unsecured credit card and a Walmart credit card which are also helping to keep my credit climbing. Also I had a few things removed from my report. I’m still working on that and removing a judgment. I’m working on buying a house soon and have already received some great offers but I’m going to wait until my credit is even better. Thank you sooooo much! This has changed my life!*"I have a lot more control than I thought."

I am a lot more confident now that I know the ins and outs of my finances, and that I have a lot more control than I thought.*"I am now about to close on my first house ever."

This process has helped me tremendously. With this process, I have cleaned up my credit, raised my credit score from 556 to 657 and I am now about to close on my first house ever. It was built brand new for me. Thank you thank you!*"I've gained 100 points"

Thank you very much for all your emails. You have been a life saver. I've gained 100 points in a year with your advice. In December, I went a little crazy for the holidays and opened department store credit cards and of course spent more than 50% of my credit limit. My scores with TransUnion went down drastically. At first I was a little depressed, but not so worried. I knew I could work at it again with the same method or strategy. Surprisingly, I did not know I was going to gain 89 points so fast in less than a month. I am so excited! THANK YOU, THANK YOU and THANK YOU!!*"Vey helpful"

Love all the great advice, it's been very helpful.*" My score was about 435 and now its over 700 and it was easy."

I've learned a great deal about my credit, credit cards, timely payments etc...when I started reading this letter my score was about 435 and now its over 700 and it was easy, I just had to follow very simple instructions.*" My credit score is up by about 150 points."

First I had to realize that credit should be taught in high school. Things are so much different than years ago. I have two credit cards now. And they have increased my limit, also. My credit score is up by about 150 points. Your guidance has helped me to achieve this.*"I've learned so much."

I think this is awesome!!!! I've learned so much and I have been spreading the word.*"Lots of information"

Your newsletter gives me lots of information, especially on things I would not normally think about.*"I was able to buy a brand new car on my own."

I have been using the program for about a year now. Through hard work and dedication my credit score has risen a hundred points. I was able to buy a brand new car on my own.*"I have a better understanding of credit and credit reports"

I retired a year ago... I had planned on working another 5 years, so this lowered my income, with too much credit card debt. I bought the CSP program to help me dig out of my hole. I have a better understanding of credit and credit reports...I understand why so many people are struggling out there, myself included. It will keep at it till the debt is paid!*"The knowledge is extremely valuable."

These emails give great information and have kept me always waiting for more to learn. The knowledge is extremely valuable. Thank you for helping me raise my score confidently.*"Within a few short months I learned how to improve my credit score by almost 50 points."

I had recently lost my job of 12 years and I had a lot of downtime so I began reading the newsletters. Within a few short months I learned how to improve my credit score by almost 50 points.*"It's helping me establish my credit again."

I like the information. It's helping me establish my credit again. I have found a unsecured credit card. I am now trying to retain a auto loan. So my situation has changed for the better...*"Helped raise my score and helped me get a new car."

Helped me find out about the hidden parts of my credit report. An old lien and old collections my ex was responsible for. Getting rid of these helped raise my score and helped me get a new car. Thanks you for your help.*"The helpful tips and knowledge shared have been priceless."

The helpful tips and knowledge shared have been priceless. Not only have I applied the information but I've shared it with my son and friends as well.*"I am getting closer to having good credit."

Not only have I been able to put money into saving,s I also am getting closer to having good credit. Hoping to have Great credit within the next 2 years.*"I have raised my husband's and my own credit score"

Since July I have raised my husband's and my own credit score by 40 points following your advice.*"Reading Mike's advice helped me get started. It has worked"

Mike makes sense of how to make a start in taking control of your finances - and not just the credit score material. I had vaguely good intentions about beginning the journey, but the task seemed so out of reach and hardly top of the endless To-Do list. But reading Mike's advice helped me get started. It has worked, and will continue. I have moved my score from the mid-500s a year ago, to just-about-to-break 700 as I write. Mike Roberts, and his e-mail newsletter, helped me do it. True story, real people.*"I pulled our credit history and was shocked at what I learned."

We were trying to get our credit score raised and we were having a difficult time doing so. I knew it had nothing to do with our present situation, so I pulled our credit history and was shocked at what I learned. There were a lot of things that were on our record that should not have been. After following your instructions, we were able to clear up almost all of our negatives. Thank you so much!!!*"Your system came to my attention at just the right time in my life."

I was single and needed a car, but my credit score was 510. I needed to know how to raise my score quickly. Your system came to my attention at just the right time in my life.*"Your newsletter has helped me clean up my credit record & stop feeling shameful."

Your newsletter has helped me get back to credit offers. I was one of those people with heavy credit card debt 7-8 years ago who went to a debt consultant for a solution. Since then I worked to pay off debt without the use of credit cards. It's been difficult but I slowly have come out of it. Your newsletter has helped me clean up my credit record & stop feeling shameful as I seek a lower interest home loan. Thanks.*"Through your program I've been able to educate my kids."

I was always in debt and I was never credit or finance savvy. Through your program I've been able to educate my kids on how not to make my same mistakes. They are using your methods and thank you very much.*"My credit score jumped up over 50 points."

I followed the advice about how much to charge on credit cards and when to close or leave cards open. So we payed down our cards accordingly and my husband and my credit score jumped up over 50 points.*"Thank you for all the advice and super beneficial solutions"

I would like to thank you for all the advice and super beneficial solutions you provide so I can align my finances with goals I’m seeking to achieve! Thanks again!*" I love what you guys are doing"

I personally love the newsletter. I love what you guys are doing educating others on credit and finances.*"Finally got myself above 700 for the first time in a long while."

LOVE it. Have picked up many tips along the way. Have increased my score nearly 50 points since I stared receiving it. Working on more. But finally got myself above 700 for the first time in a long while. Thank you!!!"Helping me stay focused"

It's a good reminder, helping me stay focused on my finances.*"I'm glad that CSP was upfront"

Through the guidance given by CSP, I was able to write the letters to the creditors and to the credit bureaus to help me with my credit scores. I also know the results don't happen overnight and I'm glad that CSP was upfront about the process and how frustrating it can be.*"I was able to move up the credit ladder"

My credit suffered badly from a divorce (if it could go wrong, it did). I used a few of your tips (piggybacking was the best), and I was able to move up the credit ladder to where my actions started to count!*"It has been of great help and an awesome resource of information."

Just want to say thank you for your newsletter, it has been of great help and an awesome resource of information. I've used the advice given to better my credit score in the last year. Thank you.*"Love the series. Very good information.*"

"It's changing our lives!!!"

Love it!!! It's changing our lives!!! Please keep all the great advice and encouragement coming!!!*"620 to 690"

My score went from 620 to 690 since I joined.*"My wife almost has a 660 credit score and I'm right behind her."

My wife and I have been moving towards the goal of buying a home. I ran across your program search the internet on how to build your credit. Every time I hear a coworker or anyone for that matter talk about bad credit I tell them all I've learned from your program. Thanks for all you do. My wife almost has a 660 credit score and I'm right behind her with my credit score. Hoping to have a 700 plus by next year.*"Few minutes a day"

Financially, the emails will guide and educate you to help you find a path to lead you to your goals. I have gained knowledge through the emails to set me on a path to have a healthy financial future. It's worth the few minutes a day to learn new ways to become unchained from bad credit. You can't achieve goals if you don't have a plan. It is not a waste of time, it's a waste to not take the time each day to educate yourself*"My eyes have been opened."

I had considered myself financially savvy until I learned from the articles and advice emailed to me. My eyes have been opened to other possibilities I didn't know existed.*"I've raised my score to 633 in less then a year."

Started with a credit score of 530. With your newsletters I've raised my score to 633 in less then a year. This is After a 30-year marriage ending in divorce and becoming disabled and on a fixed income, so it took me a little longer to pay off some bills. Working on next step to open a $1000.00 secured credit card. Thank you so much for your guidance.*"Includes great tips"

I sure look forward to the newsletter, it always includes great tips and articles. Thanks so much Credit Solution!!*"This was a great investment."

Since I have had program I love to read the emails I get. They give great pointers and honestly they really are helpful. I do take into account all that is sent and I apply to my credit or to my finances. This was a great investment that I did.*" My stress level has gone way down."

I love your program. I am still actively working it and learning how all of the credit scores work. I've heard there are new changes coming to how they score. I look forward to your updates. Awesome program. My stress level has gone way down and my debt is down by 50% and score is going up slowly. Thank you!*"Thank you, your information is helping me a lot.*"

"I now treat my credit like my reputation--no one will tarnish it. "

I knew that having a good credit score and report was important. What I learned from CSP was how credit works and strategies for fixing problems and improving my score. I now treat my credit like my reputation--no one will tarnish it. It's like your GPA; you put in your effort and protect it. I feel more educated and I'm on a mission to have excellent credit and work towards my own little house. I'm sharing the knowledge with my husband who needs to address and fix his own Credit.*"If you're finally ready to roll your sleeves up and get serious about your credit scores, this is the program that can help you do it."

CSP is a great source for credit information and handling ways to improve credit ratings. They make suggestions that are real, and worth looking into. If you're finally ready to roll your sleeves up and get serious about your credit scores, this is the program that can help you do it.*"I started with nothing...and yesterday I was approved for a $4,500 credit line"

In short it's educational, and knowledge is power. Knowledge about how credit works, credit bureaus, starting credit lines, and building on them. I started with nothing and I now have a checking account, savings account, secured credit card, and yesterday I was approved for a $4,500 credit line. Thank you*"This had changed my life."

I raised my score 200 points, I'm learning new strategies, and I'm able to budget and save money. This had changed my life.*"Easier to reach my goals."

Using all the information that you provide makes it so much easier to reach the goals I intended.*"I most appreciate your simple and clear explanations."

I read every single word you write. You are a font of information, which you share freely and liberally. I most appreciate your simple and clear explanations. In fact, I have recommended you to everyone, randomly on FB and to each of my adult children and other family members. Hopefully they have heeded my advice. After all, credit runs the world (cash in no longer King) and young people need to learn about it, too.*"Well worth it"

Raised my score from approximately 580 to 730. Took about 1 year and some diligence but well worth it.*"I paid off one credit card and got an increase on another."

I paid off one credit card and got an increase on another. I have taken on a career of claims adjusting and have to pay for everything while on the road. I am wanting to get a cash back card as soon as I can pay down my last card. I enjoy your articles.*"Easy steps to a better future.*"

"Helped me understand my finances better"

This has helped me understand my finances better, and how a lot of the credit system works.*"I am now more knowledgeable, more confident and less frightened regarding finances. "

Mike - absolutely love your program. I have filed it all, down to and including each email you have sent out. When I joined it wasn't the time for me to get serious but I knew there would come a day. About 2 weeks ago my credit score increased so I started taking a closer look. Bottom line, I am now more knowledgeable thus more confident and less frightened regarding finances. I now (at an older age) realize money is just a tool and I try not to see it as good or bad, just a tool. I have spoken of your web site and have told friends. I am not sure if they contacted and joined but I could certainly ask. You have helped me, I would be glad to help you by spreading the word. Thank you again.*"With CSP, I was able to fix and repair everything on my own."

At age 45, and after a life time of financial mismanagement, I took my future into my own hands. One time about 20 years ago I had paid someone to help with my credit. The lesson I learned from that was to not pay someone for this, it is better to do it yourself. With CSP, I was able to fix and repair everything on my own. In the end, I have great rates on my truck loan, an AMEX and Citi cards and feel much better about my prospects for buying a home after I save for the down payment.*"Very positive experience"

Overall a very positive experience. I learned a lot and have gotten some things removed that were interfering with my credit score. Thanks!*"Thanks to your information we paid off our bankruptcy 14 months early."

2010 scores were 575. We were behind on bills so we filed Chapter 13 bankruptcy and did a 100% repayment. Thanks to your information we paid off the bankruptcy 14 months early. Our scores are now 740-760-780 and we just had a offer accepted on a house with a 3.25% loan. We also have had several credit cards just sent to us so we are well on the way to recovery. Thank you.*"Tons of practical instructions"

The CSP was simplistic yet informative with tons of practical instructions I used to improve my credit score and educate myself about credit. I just wish I'd come across it a lot sooner.*"Keep it coming!"

The articles are very informative. I can't say I liked a particular one better than the other. It is straight to the point sensible informative material. Keep it coming!*"Knowledge is power"

Great information and insight. It allows me to have better understanding of the whole credit business. Knowledge is power.*"I am so fascinated with all the great information"

I just started reading your material and I am so fascinated with all the great information. I know my credit score will increase very soon. Thanks so much for such great information.*"Thanks for your help"

I have learned a lot about managing my credit and getting my credit score higher...thanks for your help.*"502 to 587 Transunion in the last 2 weeks."

I am one step ahead here as I spent all day working on my budget figuring ways to lower payments...with the expert help of Lexington Law I now have 3 collection accounts removed. My score has gone from 502 to 587 Transunion in the last 2 weeks. This all started with paying reading and concentrating on every word about debt in the Credit Solution Program. I have just begun and have a long way to go but it is a small step forward and a positive one.*"I can’t thank you enough for the change in our lives because of your advice."

I have used every bit of advice that I read every day on your emails. My husband and I want to purchase our first home but our credit was in the crapper due to some very tragic circumstances in our lives. After following each and every bit of your advice for the last year I have managed to get both our credit files to be around 620. By this summer we should be able to buy our home. Without your advice I don't think I would have been able to fix it and I didn’t want to give money to one of those places that claim they can do this for you when I knew the money would be better spend eliminating the negative items. Your advice has been a blessing and a godsend. Please keep sending your emails because every day I read them and follow every bit of your wisdom. I can’t thank you enough for the change in our lives because of your advice. I will email you when we are finally in a home that is ours and no longer have to pay rent and keep a bucket under the leaky roof.*"2 years ago my score was 504...it’s now 663"

Mike, Please believe that you are Appreciated! I found you 2 years ago when my score was 504 coming out of Bankruptcy. It’s now 663, with the Bankruptcy report still showing. I read every email I get from you and I’ve made friends who are getting their credit together join your email.*"This is the first time I have been in the excellent FICO category–for years!"

The information on specific things I could do right away to improve my credit score worked. ALL of them! My credit score improved by more than 100 points in just a few months. This is the first time I have been in the excellent FICO category–for years! Thanks Mike.*"My husband and I were finally able to purchase our home."

Your email tips have been great...my husband and I were finally able to purchase our home and stop paying rent and throwing money out the window! Thank you for your dedication to helping people.*"Simply love it!!!"

I use the newsletter a lot and simply love it!!! Keep it going……*"I’m truly glad you're there for me"

I messed up my credit in 1992 after the death of my husband. This sent me into a tailspin and I didn’t take care of my credit. Through the years I have realized how important my credit is. I’m so glad I found you and your Credit Solution Program. I just started reading but i’m learning a lot. I’m truly glad you're there for me because every other credit program charges a lot more than you do, and they aren’t as nice as you.*"My credit score went from 525 to 661 in a month"

I just want to thank you for all the information in your book. It really works wonders. My credit score went from 525 to 661 in a month and I am still working on my score.*"I'm a new man....with credit!!"

I just want to say thank you...since your advice my credit score has gone from 633-803 and Im not done yet....I still need to write a letter asking to validate a charge in collection that was never mine. Thank You again for your help Mike!! I'm a new man....with credit!!*"People need this kind of information"

You have a great program going. I really hope it takes off big for you. People need this kind of information, especially in this economy.*"When my mother passed away...she left me with a lot of financial problems that needed to be straightened out. "

When my mother passed away from Alzheimer’s disease, she left me with a lot of financial problems that needed to be straightened out. I had just gotten myself back on track with my own finances, but now these became my inherited responsibility – some of which because I had to pay a lot of her expensive medication bills with my new credit card because she had let all of her insurance lapse. Nursing home, medication, doctors, and eventually funeral arrangements amounted to quite a large expense. On top of that I was just about to retire. Your program gave me many valuable tips and as I started on the road of propping up my credit rating, I was eventually able to move out of an apartment and buy my first house. Thank you for your valuable tips, advice, and help.*"I appreciate all of the info"

My husband and I realized we weren’t putting enough money away and have since began deducting 10% more our of our paychecks for our retirement. We are both in 40’s and have time and dedication now to make that nest egg. I appreciate all of the info you provide on your site.*"Within a year's time I was able to purchase my first home."

Your program has helped me tremendously to improve credit. Through your program within a year's time I was able to purchase my first home. I appreciate each and every email that you send out. Please keep up the excellent service.*"I was able to pay off all credit card debt and have time to look for a job that was a great fit"

I got laid off in June of this year and because I was already on your site I did not panic. I was able to pay off all credit card debt and have time to look for a job that was a great fit and not just the first thing that came along. Over $28,000.00 in credit cards and other small loans. Thank you again the reminders are very helpful to keep me focused so I don’t end up in debt again.*"Thank you for all your good advice"

I have learned so much from your daily emails. I appreciate that you give good advice on financial dilemmas...most people have to decide everyday if a new credit card or loan can either help them or break them. Thank you for all your good advice.*"I enjoy getting the daily tips"

I enjoy getting the daily tips for improving my credit. I learned that lowering my credit card ratios is the quickest way to improve my credit scores. I also learned about tax liens and how they can affect my scores. Also the weight various things have in determining my score helped.*"By far the most consistent educator that gives valuable information"

I think the most important part of your emails is not just the valuable advice but how it keeps me in check with reminders of my ultimate goal. I am not disciplined at all and when I see my low score, I tend to give up quickly and about to give up all hope. But when I read your emails, it excites me, motivates, encourages and put me back on track. Especially when you remind and educate us about the simple things we can do to save, pay or negotiate. You are by far the most consistent educator that gives valuable information that is straight forward without added BS sold elsewhere. With your advice I was able to go from 500 to 640 in a matter of four months! All without paying a dime! I was also able to knock out 14 items off my reports. I am still working on it but with your awesome tips and advice, I’ve been able to make my little savings grow. It is so easy to go spend $25 or more at Target, Costco, fast food or mall, but if by following your simple simple simple advice of placing just a $1 a week (you know..the challenge of $2 for the 2nd wk, $3-3rd wk and so on) I was able to save $560 in three months. I tweaked it to placing change I received after shopping or eating out and placing it in my savings. I also placed a $20 each month or paid myself with a $50 or $100 and saved that as well. Basically, I think you help us learn how to save without feeling like we have to give up all the joys of shopping while understanding how to maintain our credit. I also exercise your other advice on life struggles. Your advice is unexpected but much appreciated."Your emails have helped me return from the dark of bad credit night"

Mike, your emails have helped me return from the dark of bad credit night. The information that I have gleaned over the previous months has given me the know-how, confidence and direction that I lacked previously...As I progress into the bright morning of stellar credit score and finances I will reflect on these lessons and look for the next step...*"I am learning so much"

I have learned a great deal and love getting all your emails and advice...keep em coming…I am learning so much from your expert advice & information.*"I have truly love receiving these emails."

I have truly love receiving these emails. I have been able to write result producing letters to help improve my credit I’m excited for more.*"I will be out of credit card debt in two weeks!"

Your Credit Solution Program is a heaven sent blessing. I will be out of credit card debt in two weeks! YAY!!!! In addition, the Credit Solution Program taught me strategies on how to eliminate debt. The debt validation letters are very effective... The Credit Solution Program has made 2014 a year of progress for me and 2015 will be the year that my credit will be excellent. This program has educated me on finances and how credit works. Now, I’m helping someone with their credit reports. It’s a great feeling.*"I didn’t know it was as easy as it was."

I have paid off 18,000 dollars in credit card debt for nearly half of the original debt. I was able to negotiate my interest and monthly payments…I didn’t know it was as easy as it was. Creditors aren’t all bad, I owed the money, I bought the products... When I realized I was in over my head most of them were more than willing to help, but I never knew it was possible until I read it here first! Thank you for your service.*"Bite-Sized Doable Steps."

Your emails and information have really helped me think clearly about my credit score and given priceless insight for getting issues resolved. When my credit took a hit, due to unemployment, it seemed like an insurmountable mountain to climb. Your help allowed me to look at it in bite sized doable steps. Thank you very much. And please don’t stop.*"Thank You"

I have been reading all of the newsletters... I have recently gotten rid of a bad credit report by following your advice and have a lot more work to do. Thank You.*"The Awareness is Amazing"

Your newsletters have been wonderful; the awareness amazing. I now keep abreast of my scores and credit report daily.*"I started with a score of 570...I have a new score of a 640"

Well for me I have disregarded my credit. I didn't think that it was important and now that I have had some education I have decided to start to look at it. Since 2010 I have a new out look on this matter. I heard about this program so now all of my focus is on it. I started with a score of 570 and with this program I have a new score of a 640. I had done some things to contest some things on my credit and got them overturned. So now this is my plan to continue to focus on this matter. Thanks Again.*"Thank You For Helping Me Get My Life, Credit, and Finances Back in Order."

First and foremost thank you for helping me get my life, credit and finances back in order. I signed up quite some time ago and at first I was a little hesitant to even give it a try. However, I had no other options, and now one, maybe two yrs later my credit score is in the high 700’s and I am much more careful of all my decisions concerning my finances, especially my credit. So thank you again, I can't begin to let you know how much your info has helped.*"726 and Rising!"

I look forward to your Credit Solution Newsletter! Using your techniques I have gone from a score below 680 to 726 and rising! Buying your Plan and implementing it has helped me focus on the important things that affect my Credit Scores! You and your Program are AWESOME! Keep those tips coming! And may you and yours have a Wonderful Holiday Season and a Prosperous New Year!*"Thank You For Making This Kind of Help Affordable"

Thank you for making this kind of help affordable to folks who by definition have financial challenges. My story may not be as glamorous as some but you have helped nobody more than me. My life has been a wreck and full of turmoil and your book marked the beginning of the change I needed. I haven't finished it…although I follow it to the letter and stay mindful of info to come… Together, the book and the newsletter have: Kept me mindful of my goals, Made learning info thats necessary easy to understand, Helped me make educated financial decisions with purpose, Wipe a negative mark off of my credit report while settling a debt at the same time, and basically raised my spirits knowing I can fix this all by myself… I've recommended your book to lots of people I know because its worth every penny… thank you thank you again!!*"Able To Buy A House With A No Money Down"

To make a very long story short, we lost our place to a predatory lender through no fault of our own. We lost 2 houses on 2 acres where we lived for a very long rime; lost about 1/3 of our income, ended up nearly on the street with not enough money for rent. We had not had any credit cards for years, so all we had was what we were left with; we had to eat from the food bank and do without a lot. Within 4 years, we had so many blessings that we were able to buy a house on VA loan with no money down and a payment we could afford. It has been a great blessing to read your emails. Thank you for all your info.*"A Better Understanding of How The System Works"

Thank you so much for this information you are providing to us. Not everyone is fortunate enough to have parents that can teach this, or do it so well, at any price. Life is not fair, and often not kind, but armed with a better understanding of how this system works, I am able to better defend myself.*"My Conscience Is CLEAR"

I was about to pay off some very old delinquent accounts when I decided to read some of your tips before doing so. I learned that they are UNCOLLECTIBLE according to the law, paying those would be a waste of hard earned money and would not help my credit score. Since they are from a predatory payday lender where I had already paid the original loan amount X2 in less than a year, my conscience is CLEAR!*"With your help I Went From Nothing To Something"

Years ago I started out with great credit and had a big blow out from family taking advantage of me and so forth to the point it ruined my credit totally. I pretty much gave up at that point and decided that I would never again be able to “finance” anything. Then I got your first post and I started reading and following intently. Low and behold, here I am around a year later and I have a great sports car, Credit Cards and at least a 650 credit score. With your help I went from nothing to something and it’s just me getting started. Just like you said about a lot of things, one is about goals, I have a goal to jump up my score at least by 150 more points in the same amount of time it took me to get this far or even shorter. And it’s all thanks to you Mike. The best I can do at this point is to wish you the best, thank you the most and offer this whole hearted virtual handshake of gratitude. Thank you so much for everything so far, right now and all to come…*"I'm so happy and proud, and house shopping soon."

I found your site 4 years ago and with your advice I cleaned my credit up completely and paid everyone in full. When I began I was 543, now I'm 758. I'm so happy and proud, and house shopping soon. Life couldn't be better, partially thanks to you for your wisdom. So glad I found you. Thank you.*"Wiped Out Over $23K In Bad Debt!"

Thanks for the constant reminders that “credit” is most integral part of our daily lives that we know the least about. Utilizing the information posted on your website and emailed to me, I have wiped out over $23K in bad debt! I have also increased my credit score by 43 points and continue the drive upwards. We appreciate you.*"I Now Understand My Mistakes"

I have always known how important my credit The good thing about having understanding of how credit works (by you sharing your knowledge) has me made see things differently...Now by your guidance I now understand my mistakes.*"Keep Up The Good Work"

As a Realtor I have many clients with credit problems. I forward your information to them. Many have been able to qualify after following your excellent advice. Keep up the good work. God Bless.*"590 to 795"

I have done a lot of work on my own going from a 590 to 795 in two years but I still love getting your tips. I think it’s great that you're spreading the news that this is important and within the power of people to better their financial future.*"This Is Definitely Helping"

Joined your program in April 2013 and have raised my score about 100 points including getting one collection agency to stop reporting and stop trying to collect!!! Thank you so much! I am gearing up to get a loan for graduate school and this is definitely helping.*"I Was Thrilled When I Found Your Blog!"

Our finances were a mess and I was looking over all of the many financial “help” and information sites that are on the web. Almost all were either wanting you to buy a system, giving out-dated or just wrong information or were so complicated that you needed a masters degree to figure them out. I was thrilled when I found your blog Mike! I have been a faithful reader ever since and I save each email for future use. We are slowly getting back on our feet and have made a financial plan that we help us stay secure.*"You Are Helping People To Change Their Lives"

Your program and emails have been a blessing to me! I went through a divorce a few years ago (23 year marriage) and lost a lot both emotionally, as well as financially. I got to a point in my life that I just didn’t care about a lot of things, especially my finances. Well, as a result of not caring and the traumatic effect of the divorce, I ended up losing several rental houses due to foreclosure. Fast forward 2-3 years, when my head finally “got right” and I decided to pull up my boot straps and get off my pity pot…so I ordered all of my credit reports and you can imagine what a mess they were. Late payments, foreclosures, charge-offs, collections, judgments, etc…..the list goes on and on. I felt like there was no way I could do anything but wait out the remaining 7 years for all the baddies to disappear. But I was determined not to settle for this, so I started “googling” ways to repair my credit report and somehow ended up here. I’ve learned so much from your program and the daily emails. I’ve even started helping other people (free of charge) to educate themselves and show them how to do disputes of their own, as well as explaining how to get secured credit cards, fingerhut accounts, etc. to build up their credit scores while simultaneously removing derogatory marks from their credit reports. What I like to call the one-two punch. Anyways, sorry for such a long post, but I felt like it was my duty to let you know that what you’re doing IS making positive changes in MANY people’s lives, so please DO NOT STOP what you’re doing. You are helping people to change their lives, as well as their financial outlook, one person at a time. Keep doing what you’re doing, it IS making a difference!*"Removed All Negatives"

I spent $600 on a firm in Southern CA who offered to handle my credit problems for me. They did nothing but take my money. So out of frustration I used the techniques in the Credit Solution Program. I contacted all my creditors, just like you advised and all of them promptly, after verification, removed all negatives and my report reflected it. Then, I employed the other suggestions. I won't bore you as you know what you recommend, but now my report by the Barclaycard credit card I received shows a FICO score of 749 and CapOne is TransUnion 671 and my bank shows my score in the mid 700s.*"520 to 605 in Three Months"

You’ve helped me tremendously. My score came up from 520 to 605 in three months. I still struggle in a few areas. However, I’m still working on it. Thank you for all that you do.*"Your Program Gave Me Hope"

First, your program gave me hope. I had sort of told myself that due to an uninsured child birth in 2008, and a failed business the following year, my credit was forever doomed. I didn’t ever see myself qualifying for a credit card or loan. My parents were well off, so I depended on them to co-sign, or give me loans. Then they passed away, and I knew, independently, I was in big trouble. You educated me on how important credit really is (it affects not only your ability to borrow money, but your rates on insurance, even your ability to get a job!). You got me moving forward to find out what my reports actually looked like. I followed the steps in your introductory videos (marking up your credit report with negative, OK, good). I took your advice on the First Progress prepaid credit card (which was a great step to rebuilding credit). I received some extra income, and at that point I was unsure whether paying off old charged off debts would help or harm my credit, so I enlisted the help of Lexington Law. So far they have been able to remove 4 negatives (using your method of verification inquiry) in about 3 months. I just applied and was approved for a Chase card with a $3,500 line of credit (which should boost my score even more). I think my score was around 527 when I first started your program. Now it’s about 650. I didn’t do it alone, but your program helped me get the ball rolling, and gave me a much better understanding of how credit works.*"I Got 12 Collections Off My Credit Report"

You have helped me learn about how credit works. I got 12 collections off my credit report & my score has gone up 20 points! I’ve also followed your advice on credit cards & savings! Thank you Mike!!!*"I Have Learned How To Be More Responsible With My Credit And Finances"

I have learned the how to be more responsible with my credit and finances. In practicing your tools I have raised my credit score over 40 points over this year. Thank you for the wealth of knowledge you have shared with us.*"From 536 to 638 In Less Than One Year"

I appreciate the knowledge you pass along. I’ve managed to get my FICO score from 536 to 638 in less than one year. I have only one negative item left on my credit and it will be paid off in the next 4 months (tax refund). I love that your emails keep my credit in the forefront of my mind. Also your tips & information have helped me take my savings from non-existent to over $4,000 in less than 6 months... Thanks again for all you’ve done and continue to do!*"My Scores Have Climbed"

Thank you for all the information that you have provided. On June 1, 2014 my credit was very bad and I couldn’t get any credit cards at all. My scores were in the 500’s. I started off with a secured Capital One credit card, and from there I took a look at my reports and wrote letters. And today I’m proud to report that my scores have climbed to low 700’s!! Thank you again.*"A Tremendous Help"

Your program has been a tremendous help…from watching our credit scores to handling old accounts…your information and sample letters did the trick…thanks again for all you do.*"Credit Habits Have All Changed"

My spending, consolidating, and credit habits have all changed. I am getting back to feeling like I am not 90% under water.*"Less than 2 weeks"

Mike I have been following your help and I am going to have say that in less than 2 weeks my credit report has gone from 555 to 589. That is only asking for the longer creditors, beyond 3 years old to be removed.*"Thank You For Saving My Marriage of 24 Years"

Just want to send out a simple THANK YOU to Mike Roberts Credit Solution. Long story short all my life had a score on average of 820 then it seemed like over night it dropped to 560. Wow. How it changes everything right down to your banker of several years doesn't even say hi anymore when doing business in the bank. Lost my job of many years, had to sell the house, made some dumb decisions, and found myself in a hotel room using their wifi wanting to know what the hell just happened to me. And as I was signing up for Transunion, CreditKarma, and Experian Credit online I ran across your Credit Solution Program. Clicking on the link linking to your story I got hooked. I have all of your emails printed in a three-hole binder that I go back and refer to now and then. Times are still tough and still climbing out of this hole...but the thank you really is for saving my marriage of 24 years.*"I Actually Had A Lightbulb Moment"

Your information breaks it down so that there's an actual understanding of how the credit system is set up. I actually had a light bulb moment... No one tells you how the score comes about. We all hear: if you don't pay the bill, X can happen, and we know when a bankruptcy happens, this will happen, and it's on there for 10 years. Just another negative item, that's all the stuff that you know. But what I didn't realize about my credit card utilization, the more I used of it, the more desperate I looked to lenders. And that was my light bulb moment. I never knew what the cut-off point should be.*"We Are Building A House"

I sent the verification letter with the Wollman letter. This is a total of over $7,000 removed...I went from a 588 on June 15th to a 716 currently and we are building a house now.*"Thanking You For Guiding Me Step By Step"

It's Brindusa here thanking you for guiding me step by step. I took the bull by the front horns, I am on the bull starting to learn how to riding it! SMILE! Downloaded the e-books and read 25 pg. already from "Settle Your Debts" part. I will save all your e-mails now and put them in a special folder, too!*"You Have All Made My Day"

Following your agency’s advice & with the help of a gentleman helping me stay in my house, I have had my credit score bump up 20 plus points. Thank You to the entire Support Team for the world class customer service. You all have made my day.*"Don't Stop!"

Thank You Mike Roberts, You are very inspiring! Your emails are valuable! Don't stop sending them! Thank You.*"It Was Extremely Easy"

I used the Credit Solution to help me dispute some of the things and I got eight things taken off. It went up a hundred and two points in 2-3 months. I would describe it like this: I read what it said, I did what it said, and that was my result. It was extremely easy. It was clear. Every T was crossed and every I was dotted. It helped a lot because there are a lot of things about credit that I did not know. So reading that, it taught me a lot more so I can be more aware of my actions and how it affects my credit. For one, I didn't know that if you have a credit card, you have to keep it at 30% or less because of a higher credit point. I didn't know that. What else was it? About opening and closing an account, and how that negatively affects your account especially when it's by the bank instead of by you, that's even worse. Things like that that helped me to understand why my credit dropped so drastically.*"I Can't Say Enough About It"

Once I started to read what Mike was putting out in his company, I thought it was very understandable, first of all. If you put it in English, people will be able to understand it. As I started to slowly acquire the knowledge with each new session, I really started to feel like I was gaining some control on things. I made a goal. I think my credit score when I started was six-something. It was quite low. I said okay, I'm going to go for 750. I wrote this down on a piece of paper and put it up on my wall, just a 750. No one else knows what it meant, nothing. It went up about 125 points when I got it within a couple of months. That's really the way the process worked for me. The materials themselves, as I say, I thought were really easy to understand, and it debunked a lot of stuff. It took all of the awesomeness and magic out of it kind of and brought it down to where I look forward to reading everything that comes. That's really how it's worked...my credit score is up even a little more than the 750 now, and it's getting better and better. Now it's not leaping, but now there's a steadiness. I think the other thing is since Mike could give you the ideas of what to do, I mean the action points of what to do, you could really start feeling empowered, as I said, to go forward. It has paid off for me. It's paid off nicely in several ways. Now I get these new credit card offers every day practically. I just rip them up. I've got plenty. I mean I'm fine. It's helping me a lot, because I'm retired and on a fixed income. I think the only other thing I can add for you is the peace of mind that you get when you get that sense of control. I keep using that word. The lack of control, I think, is one of the things that's so disheartening when it comes to things like your credit rating if you don't really know how to deal with it. That's really an important thing for peace of mind. Because I was always worried. Now,I hadn't maxed out my cards, but have a limited income. I kept thinking if my engine blows on my car, or something, and I've got $1500 I'm going to put out, I really don't want to do that at this point because I'll just be paying the rest of my life, because I've only got so much income. I sort of lived with a little bit of fear. It didn't keep me up at night, but it was enough. There was always a little gnawing, like 'oh, if I could only pay another hundred dollars on this.' Once I was well into the program, I could see things turning. Then, a couple of times I got notices, or I looked at my credit score. I thought oh, it's up. This program's been really helpful for me, and it's been an unbelievable value for me. I can't say enough about it.*"Priceless"

I was 1 of the first people to use your CSP when you had it available for free with the videos and PDF documents. Your information was a god send to me as I was going through a tough time financially and in June 2014 was notified by the IRS that I was a victim of Identity Theft. Your information and guidance helped me tremendously fighting off the CA’s that were contacting me via phone 10X daily and the barrage of Notices of Debt with the 30 days non-response= assumption of debt letters. I have an BS in Finance and a MBA from the University of Southern California, but nothing could have ever prepared me for the battles and ultimately the war over my credit score like your CSP did. I was able to use your sample letters, videos and moved my credit score from a combined average of 590 to 720 in less than 6 months... I have experienced the whole gambit from having a debt reinstated into my credit report after it had been removed by The Bankruptcy Court in 2003, to having the CRA’s (Equifax) had my birth year incorrect which upon credit inquiries automatically got it denied and the legal hassle I had to get them to correct it, after 4 attempts. The entire process I learned from your CSP in dealing with these issues is priceless.*"THANK YOU!!"

Hello, I purchased the Credit Solution Program a while back and my and my wife's credit score has increase appx. 170 points each, THANK YOU!!*"Honest and workable approach"

I must say this is the most honest, and "workable" approach I've seen to credit repair. I'll tell you what, my averaged credit score is a 560 right now because of some recent marriage/divorce issues. I'm going to put this plan into practice on my own credit file and I will keep you informed every step of the way.*"Nothing Short of Amazing"

I would like to thank you. Several years ago you placed your system online, and you had it available for free for the first xx people who viewed it. You emailed a link every week and we were able to preview the program. I was in a spot where I needed help, but was unable to follow the program at the time. What I got from the program that I remember has helped me tremendously. About a year ago, I started really working on my credit. My score was at the very bottom of the spectrum. I was showing a little over $44,000 in debt from medical bills, which were a large part not mine. Three student loans were listed doubly in my credit report, even though they were showing a zero balance, they were adding to a delinquent balance of around $20,000. The results which I have acquired are nothing short of amazing. I am currently down from the $44,000 to a little over $6,000. I am still in dispute with around $2,400 and the remaining I either have started repayment or am in the process of getting them setup. I didn't get through all of the program that you had offered. I was watching the videos on a cell phone and it was not the best to try to learn everything from. I hope that soon I will be able to get the rest of your program and really put it all into play. I just wanted to write and say thank you for your help. I look forward to updating you again in a few more months, and will explain how instrumental this information was to me in my life.*Ready to join us?

The Credit Solution Program has been perfected by over 3 years of combined research and customer feedback. The result? Our one of a kind home study course to assist you in raising your credit score, getting out of debt, and living your life in financial health.

Connect with our community of over 20,000 Facebook fans or sign up for our newsletter to get access to content on credit and other finance topics that over 1.2M subscribers trust.

Peer-reviewed research references 1. Federal Reserve Citation: Board of the Governors of the Federal Reserve System, “Report to the Congress on Credit Scoring and Its Effects on the Availability and Affordability of Credit,” Page 133, August 2007 2. The Independent Review, “Credit-Information Reporting,” Volume 5, Issue 3, Page 326, Winter 2001 3. The Journal of Consumer Affairs, “Credit Scoring and its Effects on the Availability and Affordability of Credit,” Volume 43, Number 3, Page 516, Fall 2009 4. Federal Trade Commission, “Employment Background Checks,” ftc.gov, February 2013 5. Federal Trade Commission, “How Credit Scores Affect the Price of Credit and Insurance,” consumer.ftc.gov, September 2013