When I started using credit cards to build my credit during college and years after graduation, I only looked at cards with no annual fee. I thought to myself, why should I pay a company money to be able to spend more money? That’s completely illogical, according to my ultra-frugal mentality at the time.

In the years since, I’ve added many more credit cards to my arsenal. Along the way, I started choosing cards with an annual fee. I learned that sometimes an annual fee pays off, and if you can get more value from the rewards than the cost of the fee, some cards with a fee are completely worthwhile. In fact, I’ve gone so far as to signup twice for cards with an annual fee of $450, something I wouldn’t have considered just a few years before. Let’s take a look at why some credit cards are worth an annual fee and when a card with a fee might be right for your finances.

What you get from using credit cards

About 72 percent of Americans have a credit card, according to data from the Federal Reserve, and payment processor TSYS found that roughly 40 percent of Americans prefer a credit card as a primary method of payment, as reported by CreditCards.com. Credit cards are a huge part of our financial and payments system today.

There is good reason for using credit cards. These reasons include convenience and added security. Here are some top benefits of using a credit card over other payment methods:

- Convenient – no need to carry or count cash and coins

- Widely accepted – Even most mobile businesses and food carts take cards

- Fraud protection – Most cards include automatic fraud protection at no additional cost

- Rewards – Earn cash back or miles and points for travel

- Travel insurance and purchase protection – Many of the best cards come with trip and purchase protections in case things don’t work out as planned.

The value of fraud, travel, and purchase protections are not always easy to measure, but you can easily and clearly calculate the value of cash back and travel rewards. This is what to focus on when deciding if a fee is worthwhile. But before we get to that, a quick word of warning.

Avoid the temptation to overspend and get into debt

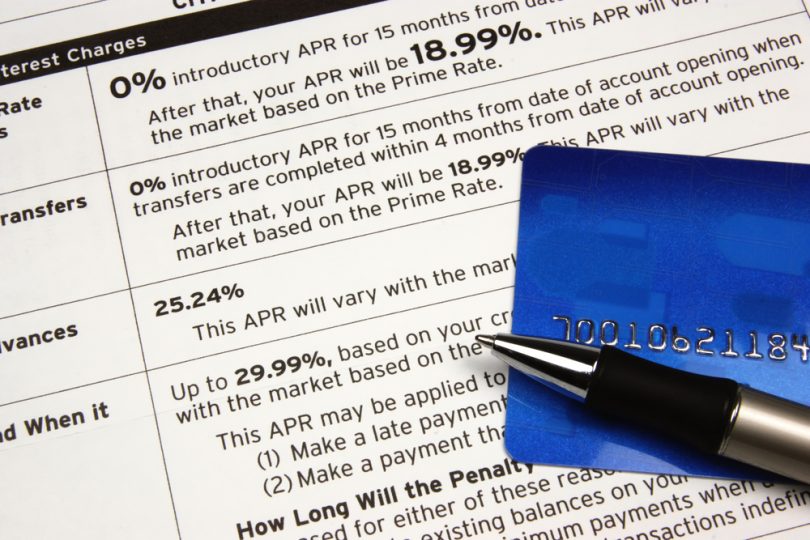

Credit cards are a financial tool, just like a bank account or a mortgage. If used well, this tool can open up doors to amazing opportunities. However, when used irresponsibly credit cards can result in huge interest charges, late and missed payment fees, cash advance fees, and a bad credit score.

Poor credit can hold you back from buying a home, getting a new car, and even requires you to put down a deposit with a phone or utility company when setting up a new account. On the other hand, excellent credit opens the door to low interest rates and the best financial products.

You know yourself and your habits better than anyone else. Be honest with yourself when deciding if credit cards are right for you. If not, it may still be a good idea to get a no fee card and stick it in the back of the drawer. If you can trust yourself to always pay on-time and keep your spending under control, credit cards are a great option for spending and payments.

Estimate the value of a card before signing up

If you track your spending and stick to a budget, which you should always do no matter what, you have access to data that can help you decide if a card with an annual fee makes sense. To understand if the fee is worthwhile, you have to know if you will get more value from rewards than the cost of the card.

For example, let’s take a look at the popular Chase Sapphire Preferred, which charges a $95 annual fee after the first year. $95 isn’t pocket change, so it is important to know you will get at least that value back from the card. Diving into the numbers, it’s easy to see the value add up.

This card comes with a 50,000-point signup bonus after spending $4,000 on purchases in the first three months after opening a new account. That bonus alone is worth at least $625 in free travel. The card offers 1 point per dollar on regular purchases and 2 points per dollar on travel and dining purchases.

Miles and points blogger The Points Guy values Sapphire Preferred points at 2.2 cents each. To break even, you would have to spend $4,318 per year on regular purchases, $2,159 on restaurant and travel purchases, or some combination. If you spend more than that per year on average, this card can make a lot of sense.

Each card has unique valuations for rewards, but the process of determining if the card is worthwhile is always the same. Calculate the break-even point, compare to your spending, and decide if the card makes sense for your needs. Keep in mind that you should base your decision on your average spending today. If you would need to spend more to make a card worth it, that card is not the right fit for your needs.

Cancel and downgrade cards that are not worth the cost

Some cards are worthwhile, but after a period of time you find the fees are not worth the cost. In this case, you have a few options. In order of preference:

- Ask for a retention bonus

- Downgrade the card

- Cancel the card

Credit card issuers spend a lot of money to bring in new customers, so sometimes it is worthwhile to give a customer a bonus to keep them around. If you spend a lot on a card, you are more likely to get this type of bonus. Just call and tell them you are considering cancelling to find out what bonuses may be available.

If there are no bonuses available, you can ask for a card downgrade. With a downgrade, you may be able to convert a card from one that charges an annual fee to a card with no fee. You may be somewhat limited in your options, but I have done this with a few cards in the past. For example, I downgraded an American Airlines card with a $450 fee to one with no fee. Doing this keeps the account open, which is better for your credit than closing a card.

Finally, you can just close a card if you can’t get a retention bonus or downgrade. If you do, ask if you can move your credit limit to another card at the same bank to avoid lowering your utilization ratio, another factor in your credit score.

Choose the right cards for your unique needs

No card is perfect for everyone, but odds are there is a card that is perfect for you. Understanding your spending habits and the rewards you value most are the first steps to picking the best card. It may turn out that the best card for you has an annual fee. In many circumstances, that can be okay.

If you know yourself and are not worried about spending or late payment problems from credit cards, they are an amazing tool. I’ve enjoyed tens of thousands of dollars in free flights and hotels thanks to credit card rewards, plus many other perks and benefits. For me, annual fees are often worthwhile. They may be for you too!